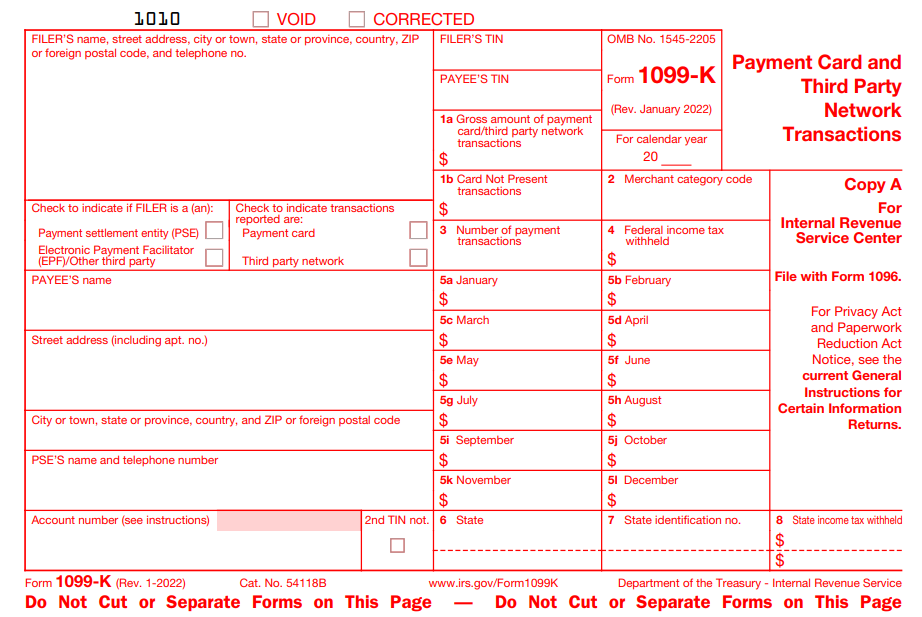

What is IRS Form 1099-K ?

The IRS Form 1099-K is used to report third-party network payments (such as payment applications and online marketplaces) and debit, credit, or stored value card payment transactions made online. Generally, Payment settlement entities (PSE) are required to file Form 1099-K with the IRS and the state and deliver recipient copies to the payee before the deadline.

What are the Changes in the 1099-K Threshold for 2023 Tax Year?

The IRS made revisions in the 1099-K Threshold & transaction limits for the 2023 tax year. As revised by American Rescue Plan Act (ARPA), the filing requirements to report Form 1099-K if the gross payment exceeds $600, regardless of the number of transactions.

Previously, Form 1099-K was not required until the payee received $20,000 in gross payments and 200 eligible transactions within the calendar year.

| Type | 2022 Tax Year | 2023 Tax Year |

|---|---|---|

| Threshold Limit | $20,000 | $600 |

| Transactions | 200 | N/A |

Benefits of E-Filing Form-1099 K

When e-filing 1099 Forms, you can take advantage of all these benefits.

Instant IRS Approval

TaxBandits allows users to file in minutes and receive instant updates from the IRS on the status of their form(s).

Postal Mail & Online Access

TaxBandits delivers your recipient copies by mail and through secure online access.

Bulk Uploads

Bulk upload templates allow you to upload all your form data at once, rather than entering it manually.

TIN Matching

TaxBandits checks the TINs in each of your forms using the SSA database. Any mismatches can be easily corrected before you transmit Form 1099-K to the IRS.

Built-in Error Checks

Your Form 1099-K will be validated for basic errors to ensure that your return is error-free before it’s transmitted to the IRS.

Download or Print Form Copies

You can download and print your recipient copies once the IRS has accepted your return.

How to File IRS Form 1099-K Online for 2023 Tax Year?

E-file Form 1099-K in 3 Simple Steps with our easy e-filing solution!

Enter Form Information

Provide the payer and payee information.

Review Information

Review the information provided and transmit the return to the IRS

Transmit to the IRS

Once the IRS accepts your return, you will receive a copy immediately by email.

When is the Deadline to File Form-1099-K for the 2023 Tax Year?

The deadline for the PSE to mail the Form 1099-K to the payee is January 31, but the deadline for paper filing with the IRS is February 28. If you file Form 1099-K electronically, the deadline is April 01.

| Type | Due Date |

|---|---|

| Recipient Copy | January 31, 2024 |

| IRS eFile | April 01, 2024 |

| IRS Paper Filing | February 28, 2024 |

Ready to E-File Form 1099-K?

Filing your Form 1099-K should be safe and easy. Complete your form and get the filing status instantly.

Contact Us

Do you have additional questions about e-filing Form 1099-K?

Frequently Asked Questions on Form 1099-K

Other Supported Forms

- Form 1099-MISC, Form 1099-NEC, INT, DIV, R, S, G, C, B, PATR & other 1099 Forms

- Form 1095-B/C, Form 1094-B/C

- Form W2, W-2c, W-2PR, W-3

- Form 941, 941-PR, 941-SS

- Form 990-N, 990-EZ, 990, 990-PF & 1120-POL

- Form 8868, Form 8809

Helpful Resources for Form 1099-K

Form W-9: Request for Taxpayer Identification Number and Certification

Invite your vendors to complete and e-sign W-9

Form W-9 is an IRS tax form used by an individual or entity to request a person's name, address, Taxpayer Identification Number (TIN) and certification from a hired contractor or vendor to e-file the 1099 information returns. IRS Form W9 is known as Request For Taxpayers Identification Number and Certification Form. With TaxBandits online portal, employers can request form W9 online and manage all W-9 forms at one place securely. Sign up now and request the first FIVE

Form W-9 for FREE.

.png)